Ta-Lib源码解析(三):蜡烛图指标 (Candlestick Indicator) #(附Python重构代码和示意图)(补充中)

TA_Lib指标目录

- 3.(蜡烛图指标)Candlestick Indicator

- 一. 前言

- 二. 单K线模型

- CDLBELTHOLD(捉腰带线)

- CDLCLOSINGMARUBOZU (收盘缺影线)

- CDLDOJI(doji十字)

- CDLDRAGONFLYDOJI (蜻蜓十字)

- CDLGRAVESTONEDOJI (墓碑十字)

- 三. 双K线模型

- CDLCOUNTERATTACK (反击线)

- CDLDARKCLOUDCOVER(乌云压顶)

- CDLDOJISTAR(十字星)

- CDLENGULFING (吞噬模式)

- CDLHAMMER(锤头)

- 四. 三K线模型

- CDL2CROW(双乌鸦)

- CDL3BLACKCROW(三乌鸦)

- CDL3INSIDE(三内部上涨和下跌)

- 三内部上涨

- 三内部下跌

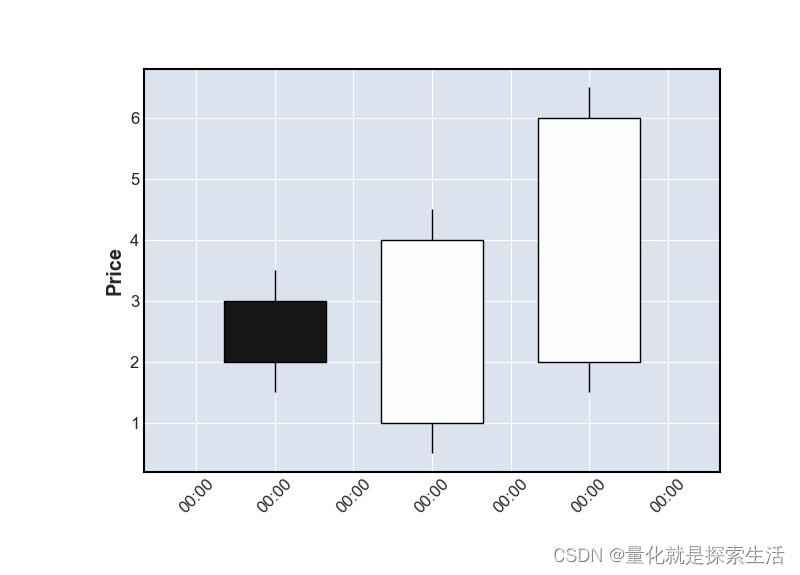

- CDL3OUTSIDE(三外部上涨和下跌)

- 三外部上涨(下跌同理)

- CDL3STARSINSOUTH (南方三星)

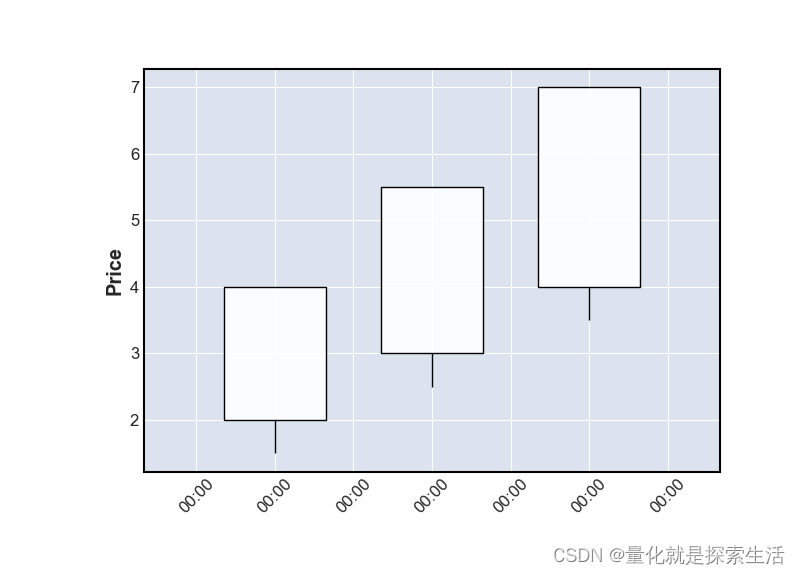

- CDL3WHITESOLDIERS (三白兵)

- CDLABANDONEDBABY(弃婴)

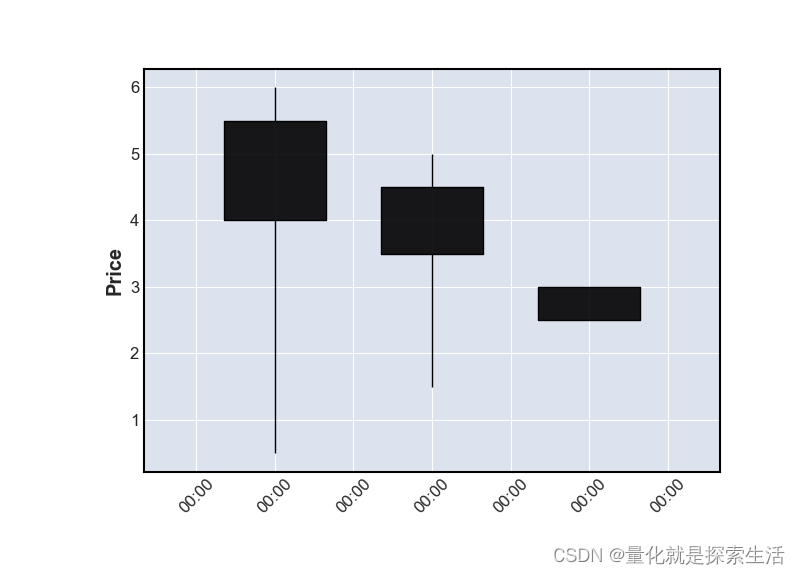

- CDLADVANCEBLOCK(大敌当前)

- 情况1:上升阻碍由于第二根bar的短实体

- 情况2:上升阻碍由于第三根bar的短实体

- 情况3:上升阻碍由于逐渐变短的实体和不短的上影线

- 情况4:上升阻碍由于第三根较短的实体和长上影线

- CDLEVENINGDOJISTAR (十字暮星)

- CDLEVENINGSTAR (暮星)

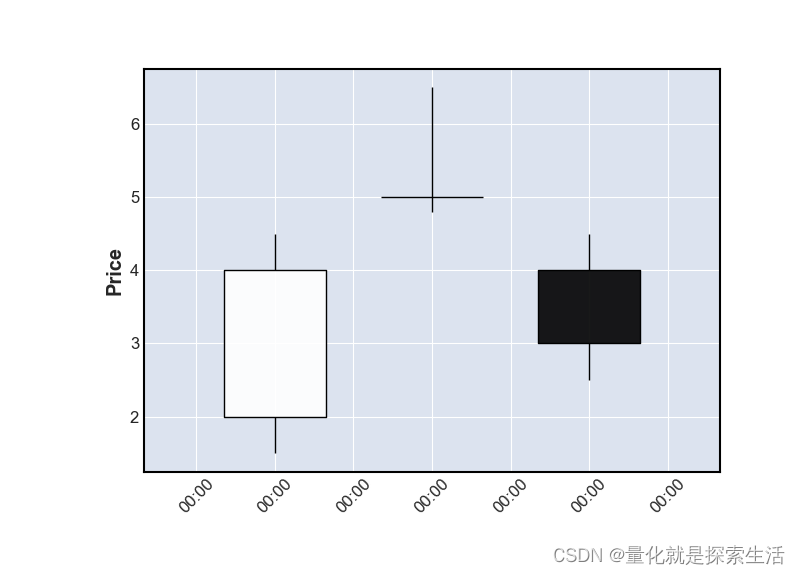

- CDLGAPSIDESIDEWHITE (向上/下跳空并列阳线)

- 五. 四K线模型

- CDL3LINESTRIKE(三线打击)

- 三连阳情况

- CDLCONCEALBABYSWALL(藏婴吞没)

- 六. 五K线模型

- CDLBREAKAWAY(脱离)

- 免责声明

3.(蜡烛图指标)Candlestick Indicator

蜡烛图指标为识别K线形态的指标,笔者认为重点在于定义方式所提供的思路,背后的投资逻辑可以借鉴但不建议直接参考

文档的翻译内容和源码逻辑存在不一致的现象,笔者分别列出中文百科中的定义和源码实际逻辑,供大家参考

一. 前言

技术分析理论中的一些模糊词,ta-lib中给出了精确的定义

源码

见 ta_global.c

TA_RetCode TA_RestoreCandleDefaultSettings( TA_CandleSettingType settingType )

{

const TA_CandleSetting TA_CandleDefaultSettings[] = {

/* real body is long when it's longer than the average of the 10 previous candles' real body */

{ TA_BodyLong, TA_RangeType_RealBody, 10, 1.0 },

/* real body is very long when it's longer than 3 times the average of the 10 previous candles' real body */

{ TA_BodyVeryLong, TA_RangeType_RealBody, 10, 3.0 },

/* real body is short when it's shorter than the average of the 10 previous candles' real bodies */

{ TA_BodyShort, TA_RangeType_RealBody, 10, 1.0 },

/* real body is like doji's body when it's shorter than 10% the average of the 10 previous candles' high-low range */

{ TA_BodyDoji, TA_RangeType_HighLow, 10, 0.1 },

/* shadow is long when it's longer than the real body */

{ TA_ShadowLong, TA_RangeType_RealBody, 0, 1.0 },

/* shadow is very long when it's longer than 2 times the real body */

{ TA_ShadowVeryLong, TA_RangeType_RealBody, 0, 2.0 },

/* shadow is short when it's shorter than half the average of the 10 previous candles' sum of shadows */

{ TA_ShadowShort, TA_RangeType_Shadows, 10, 1.0 },

/* shadow is very short when it's shorter than 10% the average of the 10 previous candles' high-low range */

{ TA_ShadowVeryShort, TA_RangeType_HighLow, 10, 0.1 },

/* when measuring distance between parts of candles or width of gaps */

/* "near" means "<= 20% of the average of the 5 previous candles' high-low range" */

{ TA_Near, TA_RangeType_HighLow, 5, 0.2 },

/* when measuring distance between parts of candles or width of gaps */

/* "far" means ">= 60% of the average of the 5 previous candles' high-low range" */

{ TA_Far, TA_RangeType_HighLow, 5, 0.6 },

/* when measuring distance between parts of candles or width of gaps */

/* "equal" means "<= 5% of the average of the 5 previous candles' high-low range" */

{ TA_Equal, TA_RangeType_HighLow, 5, 0.05 }

};

int i;

if( settingType > TA_AllCandleSettings )

return TA_BAD_PARAM;

if( settingType == TA_AllCandleSettings )

for( i = 0; i < TA_AllCandleSettings; ++i )

TA_Globals->candleSettings[i] = TA_CandleDefaultSettings[i];

else

TA_Globals->candleSettings[settingType] = TA_CandleDefaultSettings[settingType];

return TA_SUCCESS;

}

翻译

TA_BodyLong: 当期蜡烛体长度超过过去十日蜡烛体长度的平均值

TA_ShadowVeryLong: 当期蜡烛体长度超过过去十日蜡烛体长度的平均值的三倍

TA_BodyShort: 当期蜡烛体长度低于过去十日蜡烛体长度的平均值

TA_BodyDoji: 蜡烛体类似于十字线,短于过去十日蜡烛体长度的平均值的10%

TA_ShadowLong: 当期影线长度长于蜡烛体长度

TA_ShadowVeryLong: 当期影线长度长于蜡烛体长度两倍

TA_ShadowShort: 当期影线短于前十期影线长度平均值的一半

TA_ShadowVeryShort: 当期影线短于前十期high-low长度平均值的10%

TA_Near: 小于前五期20%的high-low长度平均值

TA_Far: 大于前五期60%的high-low长度平均值

TA_Equal: 小于前五期5%的high-low长度平均值

二. 单K线模型

CDLBELTHOLD(捉腰带线)

python函数原型:

cdlbelthold= CDL2BELTHOLD(open, high, low, close)

解释:

看涨为例,其开市价位于当日的最低点,然后市场一路上扬。

重构代码(来自ta_CDLBELTHOLD.c, 有修改, 只保留逻辑):

def CDLBELTHOLD_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 11:

high_low_range = high - low

shadow_very_short = high_low_range.rolling(10).mean().shift(1) * 0.1

real_body = abs(open - close)

body_long = real_body.rolling(10).mean().shift(1)

shadow_upper = high - np.maximum(close, open)

shadow_lower = np.minimum(close, open) - low

condition_1 = real_body > body_long

condition_2_1 = (close > open) & (shadow_lower < shadow_very_short)

condition_2_2 = (close < open) & (shadow_upper < shadow_very_short)

cdlbelthold = np.where(condition_1 & condition_2_1, 100, 0)

cdlbelthold = np.where(condition_1 & condition_2_2, -100, cdlbelthold)

else:

cdlbelthold = np.zeros(_len).astype(int)

return cdlbelthold

CDLCLOSINGMARUBOZU (收盘缺影线)

python函数原型:

cdlclosingmarubozu= CDLCLOSINGMARUBOZU(open, high, low, close)

解释:

中文百科:一日K线模式,以阳线为例,最低价低于开盘价,收盘价等于最高价, 预示着趋势持续。

源码与抓腰带线几乎相同

重构代码(来自ta_CDLBELTHOLD.c, 与BELTHOLD极其相似应该直接复制粘贴该条件):

def CDLCLOSINGMARUBOZU_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 11:

high_low_range = high - low

shadow_very_short = high_low_range.rolling(10).mean().shift(1) * 0.1

real_body = abs(open - close)

body_long = real_body.rolling(10).mean().shift(1)

shadow_upper = high - np.maximum(close, open)

shadow_lower = np.minimum(close, open) - low

condition_1 = real_body > body_long

condition_2_1 = (close > open) & (shadow_upper < shadow_very_short)

condition_2_2 = (close < open) & (shadow_lower < shadow_very_short)

cdlclosingmarubozu = np.where(condition_1 & condition_2_1, 100, 0)

cdlclosingmarubozu = np.where(condition_1 & condition_2_2, -100, cdlclosingmarubozu)

else:

cdlclosingmarubozu = np.zeros(_len).astype(int)

return cdlclosingmarubozu

CDLDOJI(doji十字)

python函数原型:

cdldoji = CDLDOJI(open, high, low, close)

解释:

单k线模型,十字线

重构代码(来自ta_CDLDOJI.c, 有修改, 只保留逻辑):

def CDLDOJI_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 11:

real_body = abs(open - close)

high_low_range = abs(high - low)

doji = high_low_range.rolling(10).mean().shift(1) * 0.1

condition = real_body < doji

cdldoji = np.where(condition, 100, 0)

else:

cdldoji = np.zeros(_len).astype(int)

return cdldoji

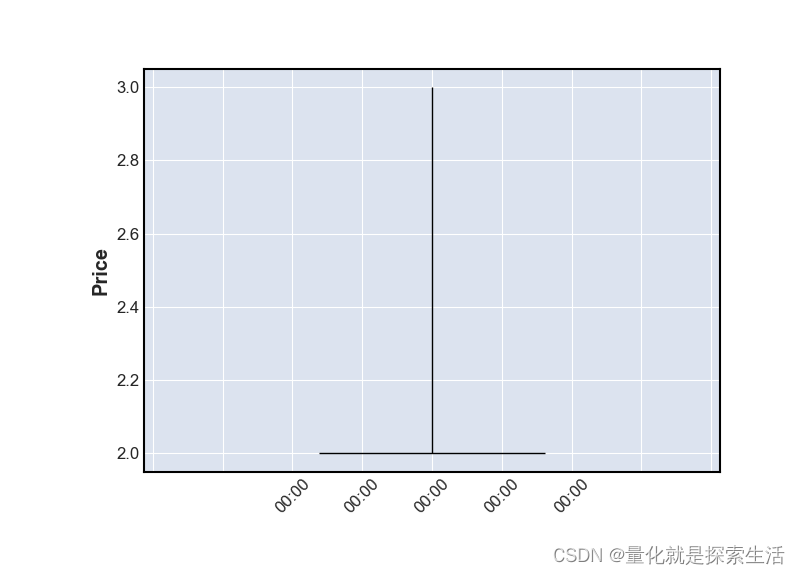

CDLDRAGONFLYDOJI (蜻蜓十字)

python函数原型:

cdldragonflydoji= CDLDRAGONFLYDOJI (open, high, low, close)

解释:

单k线模型,T字线

重构代码(来自ta_CDLDRAGONFLYDOJI.c, 有修改, 只保留逻辑):

def CDLDRAGONFLYDOJI_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 11:

real_body = abs(open - close)

high_low_range = abs(high - low)

shadow_upper = high - np.maximum(close, open)

shadow_lower = np.minimum(close, open) - low

shadow_very_short = high_low_range.rolling(10).mean().shift(1) * 0.1

doji = high_low_range.rolling(10).mean().shift(1) * 0.1

condition = (real_body < doji) & (shadow_upper < shadow_very_short) & (shadow_lower > shadow_very_short)

cdldragonflydoji = np.where(condition, 100, 0)

else:

cdldragonflydoji = np.zeros(_len).astype(int)

return cdldragonflydoji

CDLGRAVESTONEDOJI (墓碑十字)

python函数原型:

cdlgravestonedoji = CDLGRAVESTONEDOJI(open, high, low, close)

解释:

单k线模型,倒T字线

重构代码(来自ta_CDLGRAVESTONEDOJI.c, 有修改, 只保留逻辑):

def CDLGRAVESTONEDOJI_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 11:

real_body = abs(open - close)

high_low_range = abs(high - low)

shadow_upper = high - np.maximum(close, open)

shadow_lower = np.minimum(close, open) - low

shadow_very_short = high_low_range.rolling(10).mean().shift(1) * 0.1

doji = high_low_range.rolling(10).mean().shift(1) * 0.1

condition = (real_body < doji) & (shadow_upper > shadow_very_short) & (shadow_lower < shadow_very_short)

cdlgravestonedoji = np.where(condition, 100, 0)

else:

cdlgravestonedoji = np.zeros(_len).astype(int)

return cdlgravestonedoji

三. 双K线模型

CDLCOUNTERATTACK (反击线)

python函数原型:

cdlcounterattack = CDLCOUNTERATTACK(open, high, low, close)

解释:

双k线模型,一大阴一大阳,且收盘价接近,

延续第二根K线地行情

重构代码(来自ta_CDLCOUNTERATTACK.c, 有修改, 只保留逻辑):

def CDLCOUNTERATTACK_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 12:

real_body = abs(open - close)

high_low_range = abs(high - low)

equal = high_low_range.rolling(5).mean().shift(1) * 0.05

body_long = real_body.rolling(10).mean().shift(1)

condition_1_1 = (close.shift(1) > open.shift(1)) & \

(close < open)

condition_1_2 = (close.shift(1) < open.shift(1)) & \

(close > open)

condition_2 = (real_body.shift(1) > body_long.shift(1)) & \

(real_body > body_long) & \

(close <= close.shift(1) + equal.shift(1)) & \

(close >= close.shift(1) - equal.shift(1))

cdlcounterattack = np.where(condition_1_1 & condition_2, -100, 0)

cdlcounterattack = np.where(condition_1_2 & condition_2, 100, cdlcounterattack)

else:

cdlcounterattack = np.zeros(_len).astype(int)

return cdlcounterattack

CDLDARKCLOUDCOVER(乌云压顶)

python函数原型:

cdldarkcloudcover = CDLDARKCLOUDCOVER(open, high, low, close, penetration=0.5)

解释:

双k线模型,第一根大阳

第二根阴线开盘高于前一日最高

收盘再前一日实体下半部分

见顶信号

重构代码(来自ta_CDLDARKCLOUDCOVER.c, 有修改, 只保留逻辑):

def CDLDARKCLOUDCOVER_(open, high, low, close, penetration=0.5):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 12:

real_body = abs(open - close)

high_low_range = abs(high - low)

equal = high_low_range.rolling(5).mean().shift(1) * 0.05

body_long = real_body.rolling(10).mean().shift(1)

condition_1 = (close.shift(1) > open.shift(1)) & \

(real_body.shift(1) > body_long.shift(1))

condition_2 = (close < open) & \

(open > high.shift(1)) & \

(close > open.shift(1)) & \

(close < close.shift(1) - real_body.shift(1) * penetration)

cdldarkcloudcover = np.where(condition_1 & condition_2, -100, 0)

else:

cdldarkcloudcover = np.zeros(_len).astype(int)

return cdldarkcloudcover

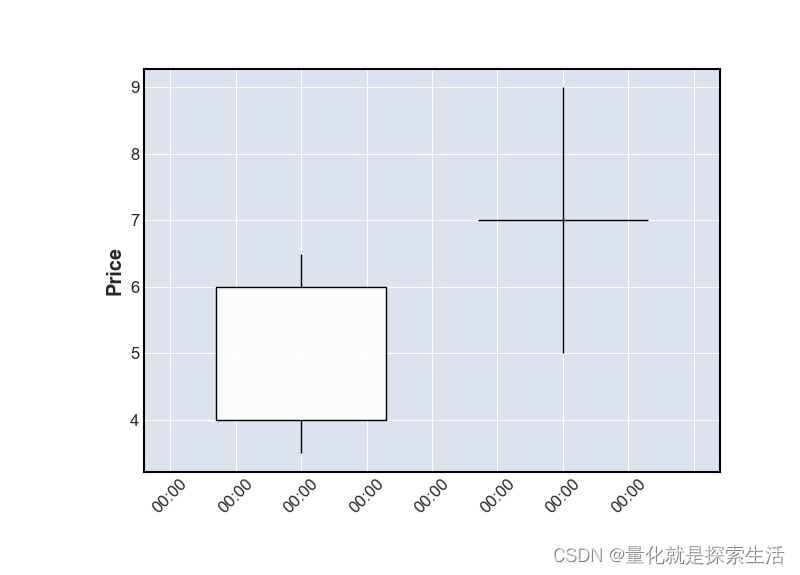

CDLDOJISTAR(十字星)

python函数原型:

cdldojistar = CDLDOJISTAR(open, high, low, close)

解释:

双k线模型,第一根大阴或者大阳

第二根高开or低开,十字星

反转信号

重构代码(来自ta_CDLDOJISTAR.c, 有修改, 只保留逻辑):

def CDLDOJISTAR_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 12:

real_body = abs(open - close)

high_low_range = abs(high - low)

doji = high_low_range.rolling(10).mean().shift(1) * 0.1

body_long = real_body.rolling(10).mean().shift(1)

condition_1_1 = (close.shift(1) > open.shift(1)) & \

(np.maximum(close, open) > close.shift(1))

condition_1_2 = (close.shift(1) < open.shift(1)) & \

(np.minimum(close, open) < close.shift(1))

condition_2 = (real_body.shift(1) > body_long.shift(1)) & \

(real_body <= doji)

cdldojistar = np.where(condition_1_1 & condition_2, -100, 0)

cdldojistar = np.where(condition_1_2 & condition_2, 100, cdldojistar)

else:

cdldojistar = np.zeros(_len).astype(int)

return cdldojistar

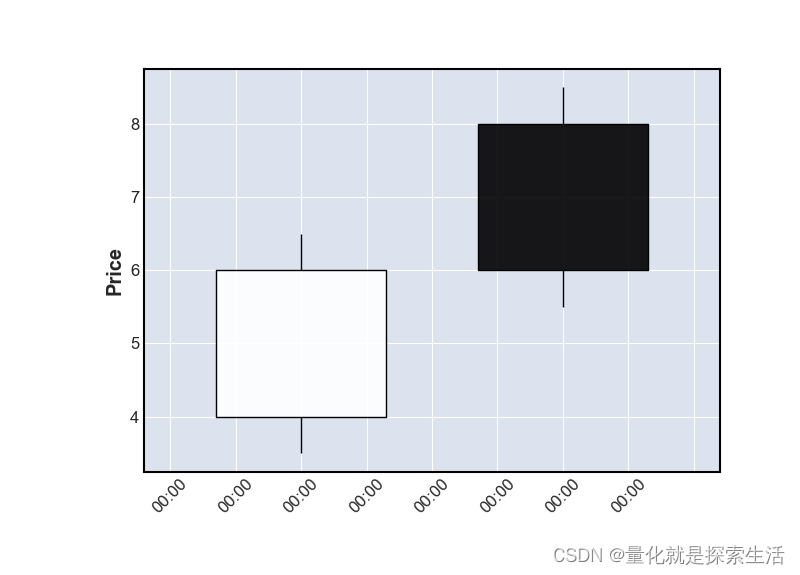

CDLENGULFING (吞噬模式)

python函数原型:

cdlengulfing= CDLENGULFING(open, high, low, close)

解释:

两日K线模式,分多头吞噬和空头吞噬,以多头吞噬为例,第一日为阴线, 第二日阳线,第一日的开盘价和收盘价在第二日开盘价收盘价之内,但不能完全相同。

重构代码(来自ta_CDLENGULFING.c, 有修改, 只保留逻辑):

def CDLENGULFING_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 12:

condition_1 = (close.shift(1) < open.shift(1)) & (close > open) & \

(close > open.shift(1)) & (open < close.shift(1))

condition_2 = (close.shift(1) > open.shift(1)) & (close < open) & \

(close < open.shift(1)) & (open > close.shift(1))

cdlengulfing = np.where(condition_1, 100, 0)

cdlengulfing = np.where(condition_2, -100, cdlengulfing)

else:

cdlengulfing = np.zeros(_len).astype(int)

return cdlengulfing

CDLHAMMER(锤头)

python函数原型:

cdlhammer = CDLHAMMER(open, high, low, close)

解释:

两日K线模式,第二日为长下影短上影的短实体,且实体下沿低于前一日最低价(Near)

重构代码(来自ta_CDLHAMMER.c, 有修改, 只保留逻辑):

def CDLHAMMER_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 12:

condition_1 = (close.shift(1) < open.shift(1)) & (close > open) & \

(close > open.shift(1)) & (open < close.shift(1))

condition_2 = (close.shift(1) > open.shift(1)) & (close < open) & \

(close < open.shift(1)) & (open > close.shift(1))

cdlengulfing = np.where(condition_1, 100, 0)

cdlengulfing = np.where(condition_2, -100, cdlengulfing)

else:

cdlengulfing = np.zeros(_len).astype(int)

return cdlengulfing

四. 三K线模型

CDL2CROW(双乌鸦)

python函数原型:

cdl2crows= CDL2CROWS(open, high, low, close)

解释:

对于双乌鸦形状的定义,中文百科和ta-lib中定义的方式不一样,

中文百科中第一天长阳线后,第二天高开收阴, 形成缺口,第三天的大阴线包裹住第二天的阴线

ta-lib中第一根和第二跟定义相同,第三跟阴线开盘价再第二根阴线开收之间,收盘价再第一根阳线开收之间

投资逻辑(仅供参考,不宜借鉴):

按照主散博弈模型,主力推高出大阳线吸引散户关注,高开吸引散户进场,主力出货一部分,再次高开吸引散户进场,主力在次出货

第一根长阳线:

O

P

E

N

−

2

−

C

L

O

S

E

−

2

>

A

V

G

(

∣

O

P

E

N

−

C

L

O

S

E

∣

)

OPEN_{-2}-CLOSE_{-2} > AVG(|OPEN-CLOSE|)

OPEN−2−CLOSE−2>AVG(∣OPEN−CLOSE∣)

第二根阴线:

O

P

E

N

−

1

>

C

L

O

S

E

−

1

>

C

L

O

S

E

−

2

OPEN_{-1} > CLOSE_{-1} > CLOSE_{-2}

OPEN−1>CLOSE−1>CLOSE−2

第三根阴线:

O

P

E

N

−

1

<

O

P

E

N

0

<

C

L

O

S

E

−

2

OPEN_{-1} < OPEN_{0} < CLOSE_{-2}

OPEN−1<OPEN0<CLOSE−2

重构代码(来自ta_CDL2CROW.c, 有修改, 只保留逻辑):

def CDL2CROWS_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

body_long = real_body.rolling(10).mean().shift(1)

# 第一根大阳线

condition1 = (close.shift(2) - open.shift(2)) > body_long.shift(2)

# 第二根阴线

condition2 = (open.shift(1) > close.shift(1)) & (close.shift(1) > close.shift(2))

# 第三根阴线

condition3 = (open.shift(1) > open) & (open > close.shift(1)) & \

(close.shift(2) > close) & (close > open.shift(2))

cdl2crow = np.where(condition1 & condition2 & condition3, -100, 0)

cdl2crow[:12] = 0

else:

cdl2crow = np.zeros(_len).astype(int)

return cdl2crow

CDL3BLACKCROW(三乌鸦)

python函数原型:

cdl3blackcrows= CDL3BLACKCROWS(open, high, low, close)

解释:

(1)连续三天长阴线。(ta-lib无此要求)

(2)每天的收盘出现新低。

(3)每天的开盘在前一天的实体内。

(4)每天的收盘等于或接近当天的最低。

(5)第一根阴线跌破前阳线最高点(ta-lib特有要求)

第一根阳线:

O

P

E

N

−

3

−

C

L

O

S

E

−

3

>

0

OPEN_{-3}-CLOSE_{-3} > 0

OPEN−3−CLOSE−3>0

第一根阴线:

O

P

E

N

−

2

>

C

L

O

S

E

−

2

C

L

O

S

E

−

2

<

H

I

G

H

−

3

C

L

O

S

E

−

2

−

L

O

W

−

2

<

A

V

G

(

C

L

O

S

E

−

L

O

W

)

−

2

OPEN_{-2} > CLOSE_{-2} \\ CLOSE_{-2} < HIGH_{-3} \\ CLOSE_{-2} - LOW_{-2} < AVG(CLOSE-LOW)_{-2}

OPEN−2>CLOSE−2CLOSE−2<HIGH−3CLOSE−2−LOW−2<AVG(CLOSE−LOW)−2

第二根阴线:

O

P

E

N

−

1

>

C

L

O

S

E

−

1

C

L

O

S

E

−

1

<

C

L

O

S

E

−

2

C

L

O

S

E

−

1

−

L

O

W

−

1

<

A

V

G

(

C

L

O

S

E

−

L

O

W

)

−

1

OPEN_{-1} > CLOSE_{-1} \\ CLOSE_{-1} < CLOSE_{-2} \\ CLOSE_{-1} - LOW_{-1} < AVG(CLOSE-LOW)_{-1}

OPEN−1>CLOSE−1CLOSE−1<CLOSE−2CLOSE−1−LOW−1<AVG(CLOSE−LOW)−1

第三根阴线:

O

P

E

N

0

>

C

L

O

S

E

0

C

L

O

S

E

0

<

C

L

O

S

E

−

1

C

L

O

S

E

0

−

L

O

W

0

<

A

V

G

(

C

L

O

S

E

−

L

O

W

)

0

OPEN_{0} > CLOSE_{0} \\ CLOSE_{0} < CLOSE_{-1} \\ CLOSE_{0} - LOW_{0} < AVG(CLOSE-LOW)_{0}

OPEN0>CLOSE0CLOSE0<CLOSE−1CLOSE0−LOW0<AVG(CLOSE−LOW)0

重构代码(来自ta_CDL3BLACKCROWS.c, 有修改, 只保留逻辑):

def CDL3BLACKCROWS_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 14:

shadow_lower = np.minimum(close, open) - low

high_low_range = abs(high - low)

shadow_very_short = high_low_range.rolling(10).mean().shift(1) * 0.1

# 第一根阳线

condition1 = (close.shift(3) - open.shift(3)) > 0

# 第一根阴线

condition2 = (open.shift(2) > close.shift(2)) & \

(close.shift(2) < high.shift(3)) & \

(shadow_lower.shift(2) < shadow_very_short.shift(2))

# 第二根阴线

condition3 = (open.shift(1) > close.shift(1)) & \

(close.shift(1) < close.shift(2)) & \

(shadow_lower.shift(1) < shadow_very_short.shift(1))

# 第三根阴线

condition4 = (open > close) & \

(close < close.shift(1)) & \

(shadow_lower < shadow_very_short)

cdl3blackcrows = np.where(condition1 & condition2 & condition3 & condition4, -100, 0)

cdl3blackcrows[:13] = 0

else:

cdl3blackcrows = int(np.zeros(_len))

return cdl3blackcrows

CDL3INSIDE(三内部上涨和下跌)

python函数原型:

cdl2inside = CDL3INSIDE(open, high, low, close)

解释:

- 母子信号是该信号的主要组成部分。第一天包裹第二天

- 母蜡烛的颜色应当与长蜡烛日的颜色相反。

- 如果趋势表明为上涨,则第三天的收盘价高于第一天的开盘价;否则,第三天的收盘价会低于第一天的开盘价。

以下四种情况皆会产生信号(四种情况,一二涨,三四跌)

三内部上涨

第一根阴线:

O

P

E

N

−

2

−

C

L

O

S

E

−

2

>

A

V

G

(

∣

O

P

E

N

−

C

L

O

S

E

∣

)

OPEN_{-2}-CLOSE_{-2} > AVG(|OPEN-CLOSE|)

OPEN−2−CLOSE−2>AVG(∣OPEN−CLOSE∣)

第二根线:

∣

O

P

E

N

−

1

−

C

L

O

S

E

−

1

∣

<

A

V

G

(

∣

O

P

E

N

−

C

L

O

S

E

∣

)

m

a

x

(

O

P

E

N

−

1

,

C

L

O

S

E

−

1

)

<

O

P

E

N

−

2

m

i

n

(

O

P

E

N

−

1

,

C

L

O

S

E

−

1

)

>

C

L

O

S

E

−

2

|OPEN_{-1} - CLOSE_{-1}| < AVG(|OPEN-CLOSE|) \\ max(OPEN_{-1}, CLOSE_{-1}) < OPEN_{-2} \\ min(OPEN_{-1}, CLOSE_{-1}) > CLOSE_{-2} \\

∣OPEN−1−CLOSE−1∣<AVG(∣OPEN−CLOSE∣)max(OPEN−1,CLOSE−1)<OPEN−2min(OPEN−1,CLOSE−1)>CLOSE−2

第三根阳线:

O

P

E

N

<

C

L

O

S

E

C

L

O

S

E

>

O

P

E

N

−

2

OPEN < CLOSE \\ CLOSE > OPEN_{-2} \\

OPEN<CLOSECLOSE>OPEN−2

三内部下跌

第一根阳线:

C

L

O

S

E

−

2

−

O

P

E

N

−

2

>

A

V

G

(

∣

O

P

E

N

−

C

L

O

S

E

∣

)

CLOSE_{-2}-OPEN_{-2} > AVG(|OPEN-CLOSE|)

CLOSE−2−OPEN−2>AVG(∣OPEN−CLOSE∣)

第二根线:

∣

O

P

E

N

−

1

−

C

L

O

S

E

−

1

∣

<

A

V

G

(

∣

O

P

E

N

−

C

L

O

S

E

∣

)

m

a

x

(

O

P

E

N

−

1

,

C

L

O

S

E

−

1

)

<

C

L

O

S

E

−

2

m

i

n

(

O

P

E

N

−

1

,

C

L

O

S

E

−

1

)

>

O

P

E

N

−

2

|OPEN_{-1} - CLOSE_{-1}| < AVG(|OPEN-CLOSE|) \\ max(OPEN_{-1}, CLOSE_{-1}) < CLOSE_{-2} \\ min(OPEN_{-1}, CLOSE_{-1}) > OPEN_{-2} \\

∣OPEN−1−CLOSE−1∣<AVG(∣OPEN−CLOSE∣)max(OPEN−1,CLOSE−1)<CLOSE−2min(OPEN−1,CLOSE−1)>OPEN−2

第三根阳线:

O

P

E

N

>

C

L

O

S

E

C

L

O

S

E

<

O

P

E

N

−

2

OPEN > CLOSE \\ CLOSE < OPEN_{-2} \\

OPEN>CLOSECLOSE<OPEN−2

重构代码(来自ta_CDL3INSIDE.c, 有修改, 只保留逻辑):

def CDL3INSIDE_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

body_long = abs(open - close)

avg_body_long = body_long.rolling(10).mean().shift(1)

# 第一根母线

condition1 = abs(close.shift(2) - open.shift(2)) > avg_body_long.shift(2)

# 第二根子线

condition2 = (abs(close.shift(1) - open.shift(1)) <= avg_body_long.shift(1)) & \

(np.maximum(close.shift(1), open.shift(1)) < np.maximum(close.shift(2), open.shift(2))) & \

(np.minimum(close.shift(1), open.shift(1)) > np.minimum(close.shift(2), open.shift(2)))

# 第三根长阴线

condition3_1 = (close.shift(2) > open.shift(2)) & (close < open) & (close < open.shift(2))

# 第三根长阳线

condition3_2 = (close.shift(2) < open.shift(2)) & (close > open) & (close > open.shift(2))

cdl3inside = np.where(condition1 & condition2 & condition3_1, -100, 0)

cdl3inside = np.where(condition1 & condition2 & condition3_2, 100, cdl3inside)

cdl3inside[:12] = 0

else:

cdl3inside = np.zeros(_len).astype(int)

return cdl3inside

CDL3OUTSIDE(三外部上涨和下跌)

python函数原型:

cdl2outside = CDL3OUTSIDE(open, high, low, close)

解释:

- 母子信号是该信号的主要组成部分,第一天包裹第二天

- 第一日和第二日的颜色相反

- 如果趋势表明为上涨,则第三天的收盘价高于第一天的开盘价;否则,第三天的收盘价会低于第一天的开盘价。

三外部上涨(下跌同理)

第一根阴线:

O

P

E

N

−

2

>

C

L

O

S

E

−

2

OPEN_{-2}>CLOSE_{-2}

OPEN−2>CLOSE−2

第二根阳线:

O

P

E

N

−

1

<

C

L

O

S

E

−

1

C

L

O

S

E

−

1

>

O

P

E

N

−

2

O

P

E

N

−

1

<

C

L

O

S

E

−

2

OPEN_{-1}<CLOSE_{-1} \\ CLOSE_{-1}>OPEN_{-2} \\ OPEN_{-1}<CLOSE_{-2} \\

OPEN−1<CLOSE−1CLOSE−1>OPEN−2OPEN−1<CLOSE−2

第三根阳线:

C

L

O

S

E

<

C

L

O

S

E

−

1

CLOSE < CLOSE_{-1}

CLOSE<CLOSE−1

重构代码(来自ta_CDL3OUTSIDE.c, 有修改, 只保留逻辑):

def CDL3OUTSIDE_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 4:

# 第一根子线阳

condition_1_1 = close.shift(2) > open.shift(2)

# 第二根母线阴

condition_1_2 = (open.shift(1) > close.shift(1)) & \

(close.shift(1) < open.shift(2)) & \

(open.shift(1) > close.shift(2))

# 第三根阴线

condition_1_3 = (close < close.shift(1))

cdl3outside = np.where(condition_1_1 & condition_1_2

& condition_1_3, -100, 0)

# 第一根子线阳

condition_2_1 = close.shift(2) < open.shift(2)

# 第二根母线阴

condition_2_2 = (open.shift(1) < close.shift(1)) & \

(close.shift(1) > open.shift(2)) & \

(open.shift(1) < close.shift(2))

# 第三根阴线

condition_2_3 = (close > close.shift(1))

cdl3outside = np.where(condition_2_1 & condition_2_2

& condition_2_3, 100, cdl3outside)

cdl3outside[:3] = 0

else:

cdl3outside = np.zeros(_len).astype(int)

return cdl3outside

CDL3STARSINSOUTH (南方三星)

python函数原型:

cdl3starsinsouth = CDL3STARSINSOUTH(open, high, low, close)

解释:

(1)三天连续阴线

(2)第一天大阴线且有较长的大影线

(3)第二天开盘位于前一天实体内,收盘位于前一天下影线内,且实体短于前一天

(4)第三天上下影线特别短(veryshort),实体短(bodyshort)且位于前一天的high,low之间

(5)见底信号

第一根阴线:

C

L

O

S

E

−

2

<

O

P

E

N

−

2

O

P

E

N

−

2

−

C

L

O

S

E

−

2

>

A

V

G

(

∣

C

L

O

S

E

−

O

P

E

N

∣

)

C

L

O

S

E

−

2

−

L

O

W

−

2

>

B

O

D

Y

_

L

O

N

G

−

2

CLOSE_{-2} < OPEN_{-2} \\ OPEN_{-2}-CLOSE{-2} > AVG(|CLOSE-OPEN|) \\ CLOSE_{-2}-LOW_{-2} > BODY\_LONG_{-2}

CLOSE−2<OPEN−2OPEN−2−CLOSE−2>AVG(∣CLOSE−OPEN∣)CLOSE−2−LOW−2>BODY_LONG−2

第二根阴线:

C

L

O

S

E

−

1

<

O

P

E

N

−

1

O

P

E

N

−

1

−

C

L

O

S

E

−

1

<

C

L

O

S

E

−

1

−

O

P

E

N

−

1

C

L

O

S

E

−

2

<

O

P

E

N

−

1

<

=

H

I

G

H

−

2

L

O

W

−

2

<

=

L

O

W

−

1

<

C

L

O

S

E

−

2

C

L

O

S

E

−

1

−

L

O

W

−

1

>

S

H

A

D

O

W

_

V

E

R

Y

_

S

H

O

R

T

−

1

CLOSE_{-1} < OPEN_{-1} \\ OPEN_{-1}-CLOSE{-1} < CLOSE_{-1} - OPEN_{-1} \\ CLOSE_{-2} < OPEN_{-1} <= HIGH_{-2} \\ LOW_{-2} <= LOW_{-1} < CLOSE_{-2} \\ CLOSE_{-1}-LOW_{-1} >SHADOW\_VERY\_SHORT_{-1}

CLOSE−1<OPEN−1OPEN−1−CLOSE−1<CLOSE−1−OPEN−1CLOSE−2<OPEN−1<=HIGH−2LOW−2<=LOW−1<CLOSE−2CLOSE−1−LOW−1>SHADOW_VERY_SHORT−1

第三根阴线:

C

L

O

S

E

<

O

P

E

N

O

P

E

N

−

C

L

O

S

E

>

B

O

D

Y

_

S

H

O

R

T

H

I

G

H

−

O

P

E

N

<

S

H

A

D

O

W

_

V

E

R

Y

_

S

H

O

R

T

C

L

O

S

E

−

L

O

W

<

S

H

A

D

O

W

_

V

E

R

Y

_

S

H

O

R

T

L

O

W

>

L

O

W

−

1

H

I

G

H

<

H

I

G

H

−

1

CLOSE<OPEN \\ OPEN-CLOSE > BODY\_SHORT \\ HIGH-OPEN < SHADOW\_VERY\_SHORT \\ CLOSE-LOW < SHADOW\_VERY\_SHORT \\ LOW > LOW_{-1} \\ HIGH < HIGH_{-1}

CLOSE<OPENOPEN−CLOSE>BODY_SHORTHIGH−OPEN<SHADOW_VERY_SHORTCLOSE−LOW<SHADOW_VERY_SHORTLOW>LOW−1HIGH<HIGH−1

重构代码(来自ta_CDL3STARSINSOUTH.c, 有修改, 只保留逻辑):

def CDL3STARSINSOUTH_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

avg_body_long = real_body.rolling(10).mean().shift(1)

body_short = real_body.rolling(10).mean().shift(1) * 0.5

shadow_lower = np.minimum(close, open) - low

high_low_range_10per = (high - low) * 0.1

shadow_very_short = high_low_range_10per.rolling(10).mean().shift(1)

shadow_upper = high - np.maximum(close, open)

# 第一根阴线

condition_1 = (close.shift(2) < open.shift(2)) & (real_body.shift(2) > avg_body_long.shift(2)) & \

(shadow_lower.shift(2) > 2 * real_body.shift(2))

# 第二根阴线

condition_2 = (close.shift(1) < open.shift(1)) & (real_body.shift(1) < real_body.shift(2)) & \

(open.shift(1) > close.shift(2)) & (open.shift(1) <= high.shift(2)) & \

(low.shift(1) < close.shift(2)) & (low.shift(1) >= low.shift(2)) & \

(shadow_lower.shift(1) > shadow_very_short.shift(1))

# 第三根阴线

condition_3 = (close < open) & (real_body < body_short) & \

(shadow_lower < shadow_very_short) & (shadow_upper < shadow_very_short) & \

(low > low.shift(1)) & (high < high.shift(1))

cdl3starsinsouth = np.where(condition_1 & condition_2 & condition_3, 100, 0)

else:

cdl3starsinsouth = np.zeros(_len).astype(int)

return cdl3starsinsouth

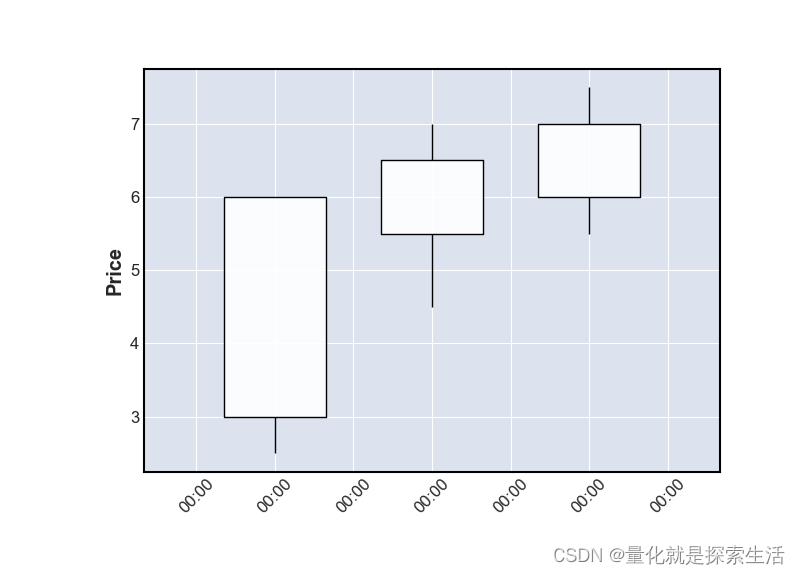

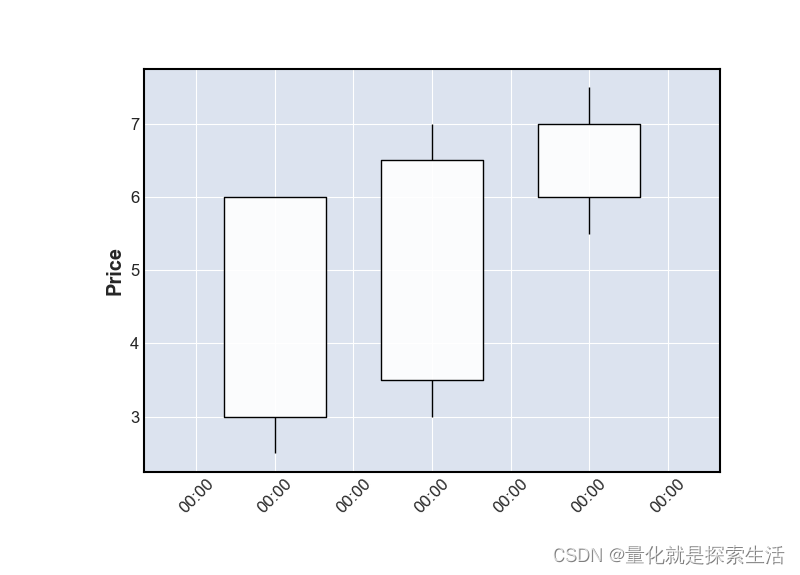

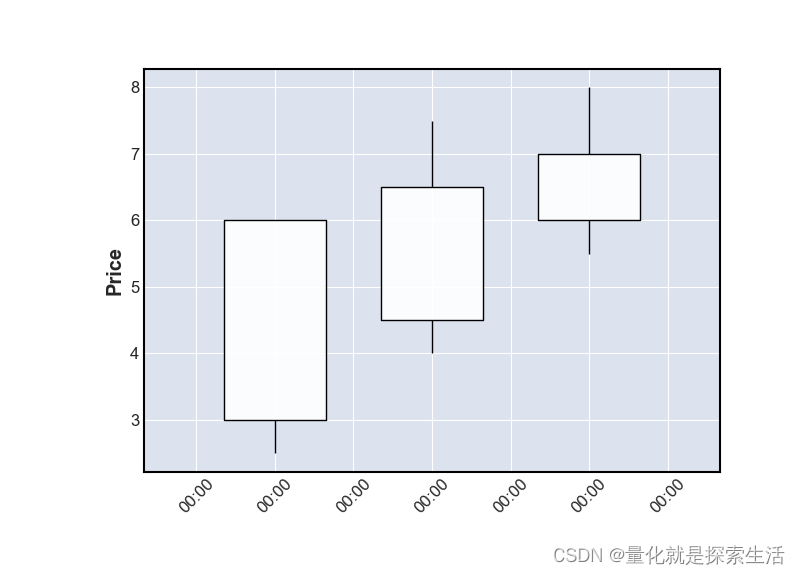

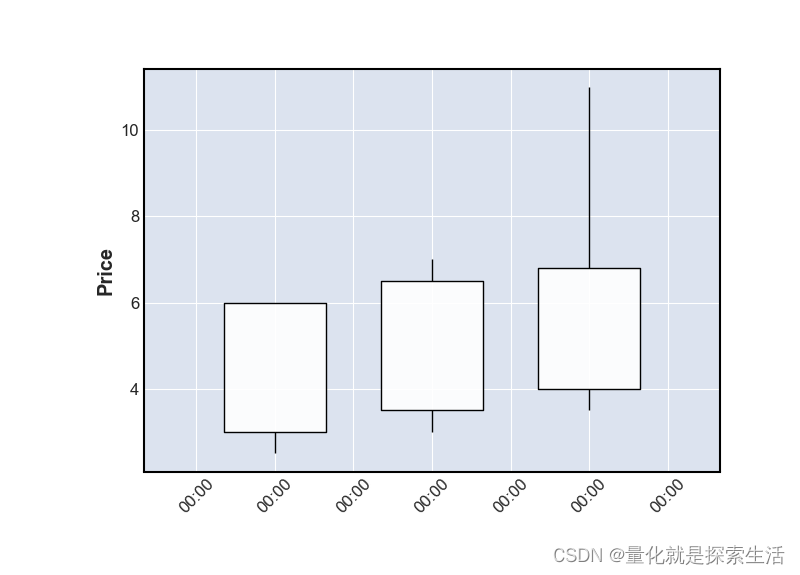

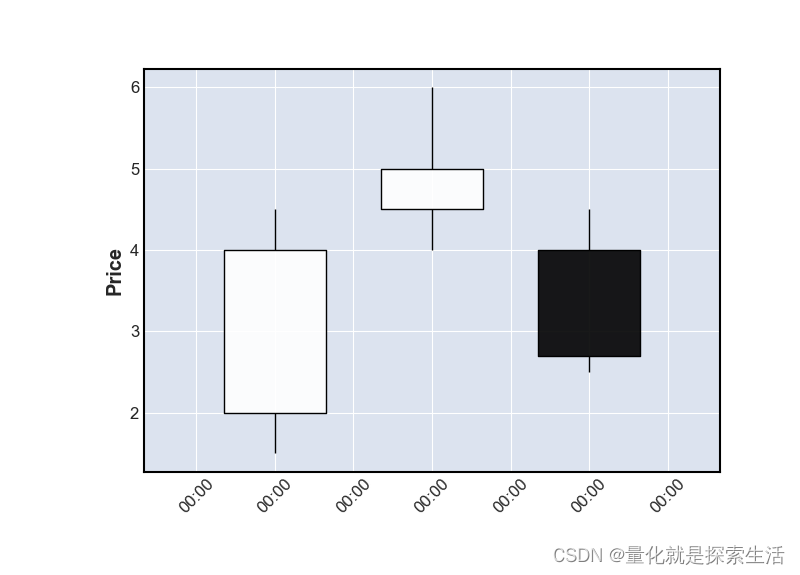

CDL3WHITESOLDIERS (三白兵)

python函数原型:

cdl3whitesoldiers = CDL3WHITESOLDIERS(open, high, low, close)

解释:

(1)三天连续阳线

(2)三天上影线非常短

(3)开盘价接近(near)前一日实体之内

(4)后一日实体不比前一日小很多(far)

(5)最后一日实体不短(bodyshort)

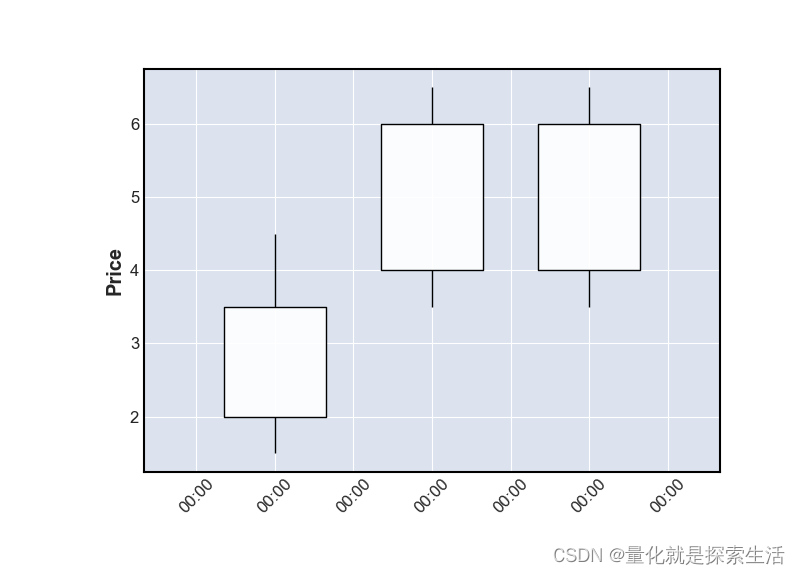

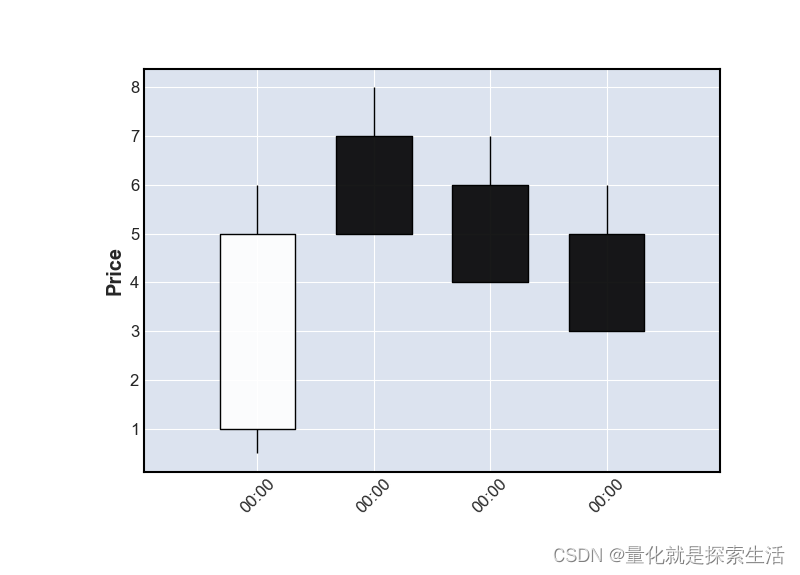

示意图:

第一日阳线:

C

L

O

S

E

−

2

>

O

P

E

N

−

2

S

H

A

D

O

W

_

U

P

P

E

R

−

2

>

S

H

A

D

O

W

_

V

E

R

Y

_

S

H

O

R

T

−

2

CLOSE_{-2} > OPEN_{-2} \\ SHADOW\_UPPER_{-2} > SHADOW\_VERY\_SHORT_{-2}

CLOSE−2>OPEN−2SHADOW_UPPER−2>SHADOW_VERY_SHORT−2

第二日阳线:

C

L

O

S

E

−

1

>

O

P

E

N

−

1

S

H

A

D

O

W

_

U

P

P

E

R

−

1

>

S

H

A

D

O

W

_

V

E

R

Y

_

S

H

O

R

T

−

1

C

L

O

S

E

−

1

>

C

L

O

S

E

−

2

O

P

E

N

−

1

>

O

P

E

N

−

2

O

P

E

N

−

1

<

=

C

L

O

S

E

−

2

+

N

E

A

R

R

E

A

L

_

B

O

D

Y

−

1

>

R

E

A

L

_

B

O

D

Y

−

2

−

F

A

R

CLOSE_{-1} > OPEN_{-1} \\ SHADOW\_UPPER_{-1} > SHADOW\_VERY\_SHORT_{-1} \\ CLOSE_{-1} > CLOSE_{-2} \\ OPEN_{-1} > OPEN_{-2} \\ OPEN_{-1} <= CLOSE_{-2} + NEAR \\ REAL\_BODY_{-1} > REAL\_BODY_{-2} - FAR

CLOSE−1>OPEN−1SHADOW_UPPER−1>SHADOW_VERY_SHORT−1CLOSE−1>CLOSE−2OPEN−1>OPEN−2OPEN−1<=CLOSE−2+NEARREAL_BODY−1>REAL_BODY−2−FAR

第三日阳线:

C

L

O

S

E

>

O

P

E

N

S

H

A

D

O

W

_

U

P

P

E

R

>

S

H

A

D

O

W

_

V

E

R

Y

_

S

H

O

R

T

C

L

O

S

E

>

C

L

O

S

E

−

1

O

P

E

N

>

O

P

E

N

−

1

O

P

E

N

<

=

C

L

O

S

E

−

1

+

N

E

A

R

R

E

A

L

_

B

O

D

Y

>

R

E

A

L

_

B

O

D

Y

−

1

−

F

A

R

R

E

A

L

_

B

O

D

Y

>

B

O

D

Y

_

S

H

O

R

T

CLOSE > OPEN \\ SHADOW\_UPPER > SHADOW\_VERY\_SHORT \\ CLOSE > CLOSE_{-1} \\ OPEN > OPEN_{-1} \\ OPEN <= CLOSE_{-1} + NEAR \\ REAL\_BODY > REAL\_BODY_{-1} - FAR \\ REAL\_BODY > BODY\_SHORT

CLOSE>OPENSHADOW_UPPER>SHADOW_VERY_SHORTCLOSE>CLOSE−1OPEN>OPEN−1OPEN<=CLOSE−1+NEARREAL_BODY>REAL_BODY−1−FARREAL_BODY>BODY_SHORT

重构代码(来自ta_CDL3LINESTRKE.c, 有修改, 只保留逻辑):

def CDL3WHITESOLDIERS_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

body_short = real_body.rolling(10).mean().shift(1) * 0.5

high_low_range_10per = (high - low) * 0.1

shadow_very_short = high_low_range_10per.rolling(10).mean().shift(1)

shadow_upper = high - np.maximum(close, open)

high_low_range_20per = (high - low) * 0.2

high_low_range_60per = (high - low) * 0.6

near = high_low_range_20per.rolling(5).mean().shift(1)

far = high_low_range_60per.rolling(5).mean().shift(1)

# 第一根阳线

condition_1 = (close.shift(2) > open.shift(2)) & (shadow_upper.shift(2) < shadow_very_short.shift(2))

# 第二根阳线

condition_2 = (close.shift(1) > open.shift(1)) & (shadow_upper.shift(1) < shadow_very_short.shift(1)) & \

(close.shift(1) > close.shift(2)) & (open.shift(1) > open.shift(2)) & \

(open.shift(1) <= close.shift(2) + near.shift(2)) & \

(real_body.shift(1) > real_body.shift(2) - far.shift(2))

# 第三根阳线

condition_3 = (close > open) & (shadow_upper < shadow_very_short) & (close > close.shift(1)) & \

(open > open.shift(1)) & (open <= close.shift(1) + near.shift(1)) & \

(real_body > real_body.shift(1) - far.shift(1)) & \

(real_body > body_short)

cdl3whitesoldiers = np.where(condition_1 & condition_2 & condition_3, 100, 0)

else:

cdl3whitesoldiers = np.zeros(_len).astype(int)

return cdl3whitesoldiers

CDLABANDONEDBABY(弃婴)

python函数原型:

cdlabandonedbaby = CDLABANDONEDBABY(open, high, low, close, penetration=0.3)

解释:

(1)三天K线,若第一日涨

(2)第二日跳空高开且收十字星

(3)第三日低开收阴

(4)预示反转

顶部为例:

第一根阳线:

C

L

O

S

E

−

2

>

O

P

E

N

−

2

R

E

A

L

_

B

O

D

Y

−

2

>

B

O

D

Y

_

L

O

N

G

−

2

CLOSE_{-2} > OPEN_{-2} \\ REAL\_BODY_{-2} > BODY\_LONG_{-2}

CLOSE−2>OPEN−2REAL_BODY−2>BODY_LONG−2

第二根上缺口:

R

E

A

L

_

B

O

D

Y

−

1

<

=

B

O

D

Y

_

D

O

J

I

−

1

L

O

W

−

1

>

H

I

G

H

−

2

REAL\_BODY_{-1} <= BODY\_DOJI_{-1} \\ LOW_{-1} > HIGH_{-2}

REAL_BODY−1<=BODY_DOJI−1LOW−1>HIGH−2

第三跟阴线:

C

L

O

S

E

>

O

P

E

N

R

E

A

L

_

B

O

D

Y

>

B

O

D

Y

_

L

O

N

G

C

L

O

S

E

<

C

L

O

S

E

−

2

−

R

E

A

L

_

B

O

D

Y

−

2

×

P

E

N

E

T

R

A

T

I

O

N

L

O

W

−

1

>

H

I

G

H

CLOSE > OPEN \\ REAL\_BODY > BODY\_LONG \\ CLOSE < CLOSE_{-2} - REAL\_BODY_{-2} \times PENETRATION \\ LOW_{-1} > HIGH

CLOSE>OPENREAL_BODY>BODY_LONGCLOSE<CLOSE−2−REAL_BODY−2×PENETRATIONLOW−1>HIGH

重构代码(来自ta_CDLABANDONEDBABY.c, 有修改, 只保留逻辑):

def CDLABANDONEDBABY_(open, high, low, close, penetration=0.3):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

body_short = real_body.rolling(10).mean().shift(1) * 0.5

body_long = real_body.rolling(10).mean().shift(1)

body_doji = real_body.rolling(10).mean().shift(1) * 0.1

# 第一根阳线

condition_1_1 = (close.shift(2) > open.shift(2)) & (real_body.shift(2) > body_long.shift(2))

# 第二根上缺口

condition_1_2 = (real_body.shift(1) <= body_doji.shift(1)) & \

(low.shift(1) > high.shift(2))

# 第三根阴线

condition_1_3 = (close < open) & (real_body > body_short) & \

(close < close.shift(2) - real_body.shift(2) * penetration) & \

(low.shift(1) > high)

cdl3abandonbaby = np.where(condition_1_1 & condition_1_2 & condition_1_3, -100, 0)

# 第一根阳线

condition_2_1 = (close.shift(2) < open.shift(2)) & (real_body.shift(2) > body_long.shift(2))

# 第二根上缺口

condition_2_2 = (real_body.shift(1) <= body_doji.shift(1)) & \

(high.shift(1) < low.shift(2))

# 第三根阴线

condition_2_3 = (close > open) & (real_body > body_short) & \

(close > close.shift(2) + real_body.shift(2) * penetration) & \

(high.shift(1) < low)

cdl3abandonbaby = np.where(condition_2_1 & condition_2_2 & condition_2_3, 100, cdl3abandonbaby)

else:

cdl3abandonbaby = np.zeros(_len).astype(int)

return cdl3abandonbaby

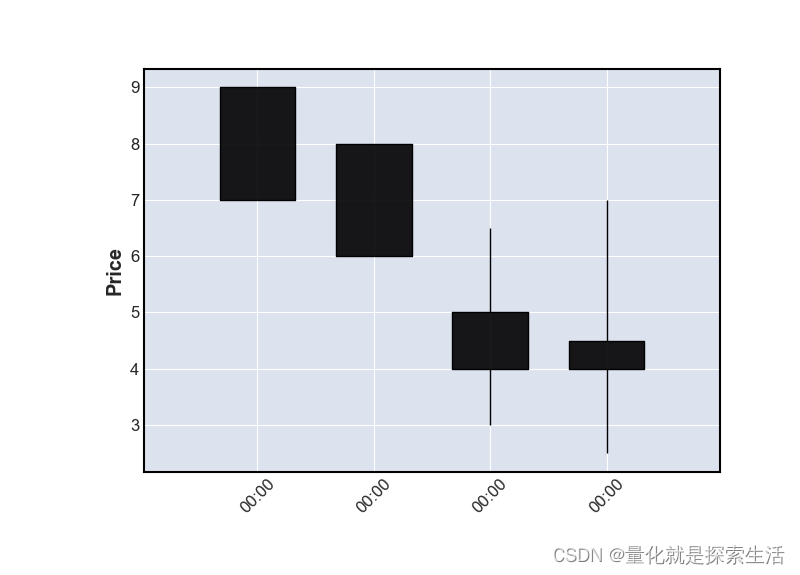

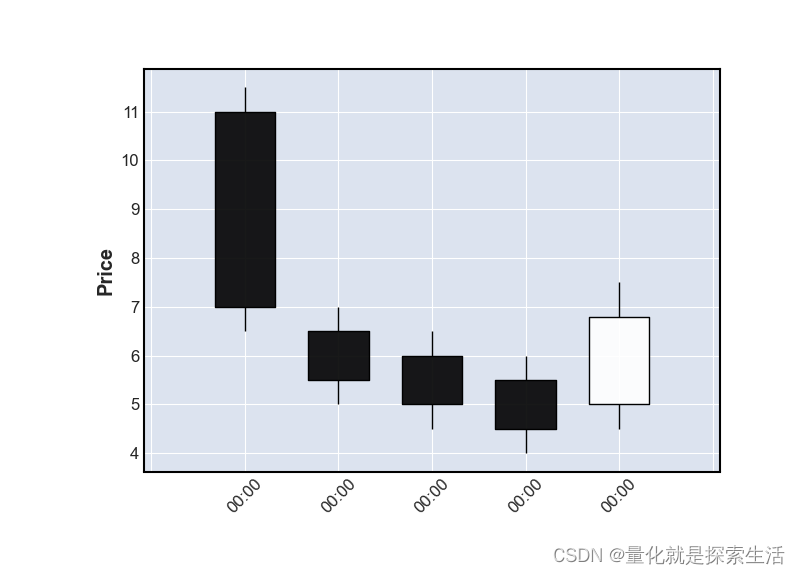

CDLADVANCEBLOCK(大敌当前)

python函数原型:

cdladvanceblock = = CDLADVANCEBLOCK(open, high, low, close)

百科解释:三日K线模式,三日都收阳,每日收盘价都比前一日高, 开盘价都在前一日实体以内,实体变短,上影线变长。

talib中定义了四种满足advanceblock的条件

公共条件:

- 三练阳,收盘价逐日往上

- 三日开盘价高于前一日开盘价,不超过(near)前一日收盘价

- 首日长实体(body_long),短上影线(shadow_short)

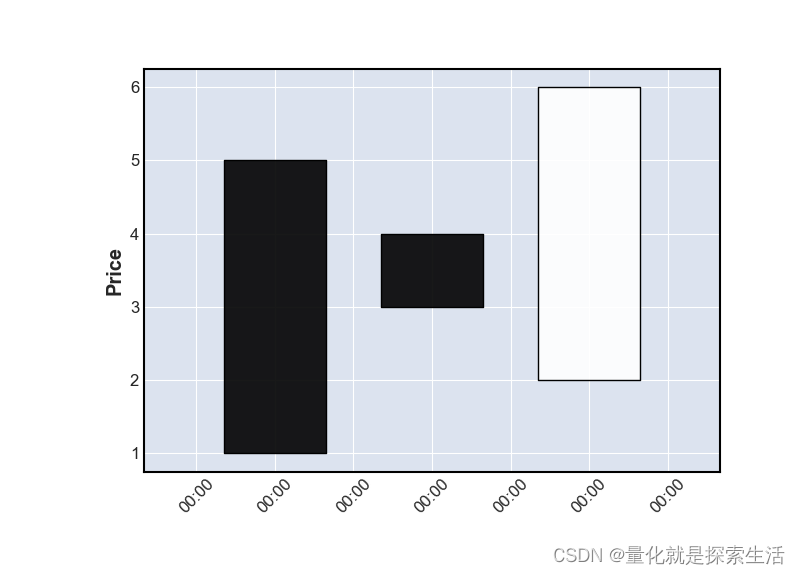

情况1:上升阻碍由于第二根bar的短实体

- 第二日实体远短于(far)第一日实体

- 第三日实体不长于(near)第二日实体

R E A L _ B O D Y − 1 < R E A L _ B O D Y − 2 − F a r − 2 R E A L _ B O D Y 0 < R E A L _ B O D Y − 1 + N e a r − 1 REAL\_BODY_{-1} < REAL\_BODY_{-2} - Far_{-2} \\ REAL\_BODY_{0} < REAL\_BODY_{-1} + Near_{-1} REAL_BODY−1<REAL_BODY−2−Far−2REAL_BODY0<REAL_BODY−1+Near−1

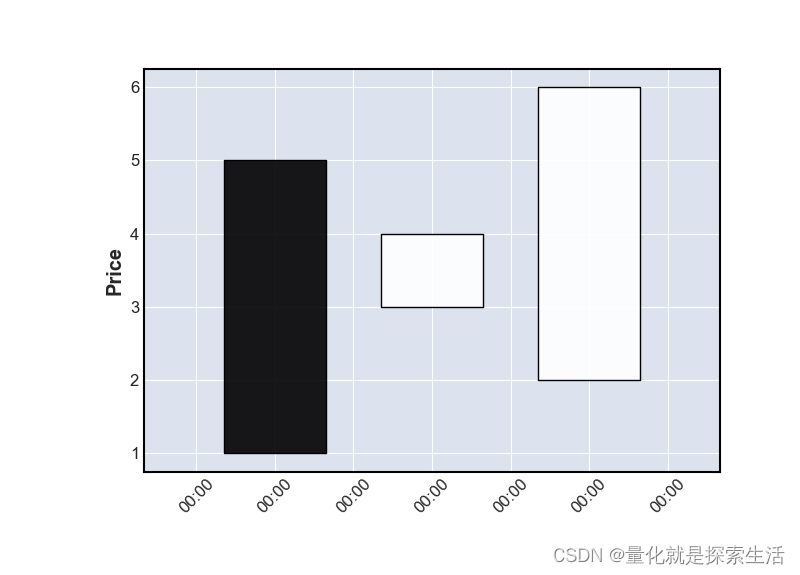

情况2:上升阻碍由于第三根bar的短实体

- 第三日实体远短于(far)第二日实体

R E A L _ B O D Y 0 < R E A L _ B O D Y − 1 − F a r − 1 REAL\_BODY_{0} < REAL\_BODY_{-1} - Far_{-1} REAL_BODY0<REAL_BODY−1−Far−1

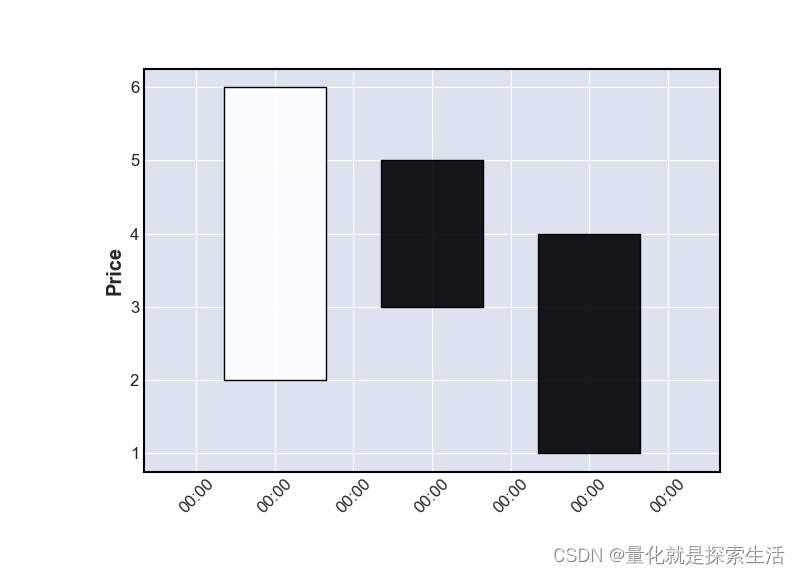

情况3:上升阻碍由于逐渐变短的实体和不短的上影线

- 第三根实体小于第二根,第二根实体小于第一根

- 第三根或第二根上影线不短(shadow_short)

R E A L _ B O D Y − 1 < R E A L _ B O D Y − 2 R E A L _ B O D Y 0 < R E A L _ B O D Y − 1 ( S H A D O W _ U P P E R 0 > S H A D O W _ S H O R T 0 ) o r ( S H A D O W _ U P P E R − 1 > S H A D O W _ S H O R T − 1 ) REAL\_BODY_{-1} < REAL\_BODY_{-2} \\ REAL\_BODY_{0} < REAL\_BODY_{-1} \\ (SHADOW\_UPPER_{0} > SHADOW\_SHORT_{0})\ or \\ (SHADOW\_UPPER_{-1} > SHADOW\_SHORT_{-1}) REAL_BODY−1<REAL_BODY−2REAL_BODY0<REAL_BODY−1(SHADOW_UPPER0>SHADOW_SHORT0) or(SHADOW_UPPER−1>SHADOW_SHORT−1)

情况4:上升阻碍由于第三根较短的实体和长上影线

- 第三根实体小于第二根

- 第三根上影线长(shadow_long)

R E A L _ B O D Y 0 < R E A L _ B O D Y − 1 S H A D O W _ U P P E R 0 > S H A D O W _ L O N G 0 REAL\_BODY_{0} < REAL\_BODY_{-1} \\ SHADOW\_UPPER_{0} > SHADOW\_LONG_{0} REAL_BODY0<REAL_BODY−1SHADOW_UPPER0>SHADOW_LONG0

重构代码(来自ta_CDL3LINESTRKE.c, 有修改, 只保留逻辑):

def CDLADVANCEBLOCK_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

body_long = real_body.rolling(10).mean().shift(1)

high_low_range = high - low

near = high_low_range.rolling(5).mean().shift(1) * 0.2

far = high_low_range.rolling(5).mean().shift(1) * 0.6

shadow_upper = high - np.maximum(close, open)

shadow_lower = np.minimum(close, open) - low

shadow_short = (shadow_upper + shadow_lower).rolling(10).mean().shift(1) * 0.5

common_condition = (close.shift(2) > open.shift(2)) & (close.shift(1) > open.shift(1)) & \

(close > open) & (close > close.shift(1)) & (close.shift(1) > close.shift(2)) & \

(open.shift(1) > open.shift(2)) & (open.shift(1) <= close.shift(2) + near.shift(2)) & \

(open > open.shift(1)) & (open < close.shift(1) + near.shift(1)) & \

(real_body.shift(2) > body_long.shift(2)) & (shadow_upper.shift(2) < shadow_short.shift(2))

# 第二根远小于第一根, 第三根不长于第二根

# 上升阻碍在第二根bar,第三根不得阻碍

condition_1 = (real_body.shift(1) < real_body.shift(2) - far.shift(2)) & \

(real_body < real_body.shift(1) + near.shift(1))

# 第三更远小于第二根

# 上升阻碍在第三根bar

condition_2 = (real_body < real_body.shift(1) - far.shift(1))

# 第三根小于第二根,第二根小于第一根, 第三和第二根不具有长上影线

# 上升阻碍在逐渐变小地上影线和实体

condition_3 = (real_body.shift(1) < real_body.shift(2)) & (real_body < real_body.shift(1)) & \

(shadow_upper > shadow_short) & (shadow_upper.shift(1) > shadow_short.shift(1))

# 第三根小于第二根, 第三根有很长地上影线

# 上升阻碍在第三根长上影线和短实体

condition_4 = (real_body < real_body.shift(1)) & (shadow_upper > real_body)

cdladvanceblock = np.where(common_condition & (condition_1 | condition_2 | condition_3 | condition_4), -100, 0)

else:

cdladvanceblock = np.zeros(_len).astype(int)

return cdladvanceblock

CDLEVENINGDOJISTAR (十字暮星)

python函数原型:

cdleveningdojistar = CDLEVENINGDOJISTAR (open, high, low, close, penetration=0.3)

解释:

与CDLABANDONEDBABY(弃婴)非常相似,缺口放宽至实体缺口

- 第一日大阳线

- 第二日高开十字线

- 第三日大阴线,收盘小于第一根实体的30%分位数

重构代码(来自ta_CDLEVENINGDOJISTAR.c, 有修改, 只保留逻辑):

def CDLEVENINGDOJISTAR_(open, high, low, close, penetration=0.3):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

body_long = real_body.rolling(10).mean().shift(1)

high_low_range = high - low

doji = high_low_range.rolling(10).mean().shift(1) * 0.1

condition_1 = (real_body.shift(2) > body_long.shift(2)) & \

(close.shift(2) > open.shift(2))

condition_2 = (real_body.shift(1) < doji.shift(1)) & \

(np.minimum(close.shift(1), open.shift(1)) > close.shift(2))

condition_3 = (real_body > body_long) & \

(close < open) & \

(close < close.shift(2) - real_body.shift(2) * penetration)

cdleveningdojistar = np.where(condition_1 & condition_2 & condition_3, -100, 0)

else:

cdleveningdojistar = np.zeros(_len).astype(int)

return cdleveningdojistar

CDLEVENINGSTAR (暮星)

python函数原型:

cdleveningstar= CDLEVENINGSTAR (open, high, low, close, penetration=0.3)

与CDLEVENINGDOJISTAR (十字暮星)非常相似,十字线放宽至短线

- 第一日大阳线

- 第二日高开短线

- 第三日大阴线,收盘小于第一根实体的30%分位数

重构代码(来自ta_CDLEVENINGSTAR.c, 有修改, 只保留逻辑):

def CDLEVENINGSTAR_(open, high, low, close, penetration=0.3):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

body_long = real_body.rolling(10).mean().shift(1)

condition_1 = (real_body.shift(2) > body_long.shift(2)) & \

(close.shift(2) > open.shift(2))

condition_2 = (real_body.shift(1) <= body_long.shift(1)) & \

(np.minimum(close.shift(1), open.shift(1)) > close.shift(2))

condition_3 = (real_body > body_long) & \

(close < open) & \

(close < close.shift(2) - real_body.shift(2) * penetration)

cdleveningstar = np.where(condition_1 & condition_2 & condition_3, -100, 0)

else:

cdleveningstar = np.zeros(_len).astype(int)

return cdleveningstar

CDLGAPSIDESIDEWHITE (向上/下跳空并列阳线)

python函数原型:

cdlgapsidesidewhite = CDLGAPSIDESIDEWHITE(open, high, low, close)

解释:

向上或向下跳空后,两根并列(equal)几乎等长(Near)的阳线

趋势方向为跳空方向

三连阴情况类似

重构代码(来自ta_CDLGAPSIDESIDEWHITE.c, 有修改, 只保留逻辑):

def CDLGAPSIDESIDEWHITE_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 13:

real_body = abs(open - close)

high_low_range = high - low

near = high_low_range.rolling(5).mean().shift(1) * 0.2

equal = high_low_range.rolling(5).mean().shift(1) * 0.05

# 向上跳空

condition_1_1 = np.maximum(close.shift(2), open.shift(2)) < np.minimum(open.shift(1), open)

# 向下跳空

condition_1_2 = np.minimum(close.shift(2), open.shift(2)) > np.minimum(close.shift(1), close)

condition_2 = (close.shift(1) > open.shift(1)) & \

(close > open)

condition_3 = (real_body <= real_body.shift(1) + near.shift(1)) & \

(real_body >= real_body.shift(1) - near.shift(1)) & \

(open <= open.shift(1) + equal.shift(1)) & \

(open >= open.shift(1) - equal.shift(1))

cdlgapsidesidewhite = np.where(condition_1_1 & condition_2 & condition_3, 100, 0)

cdlgapsidesidewhite = np.where(condition_1_2 & condition_2 & condition_3, -100, cdlgapsidesidewhite)

else:

cdlgapsidesidewhite = np.zeros(_len).astype(int)

return cdlgapsidesidewhite

五. 四K线模型

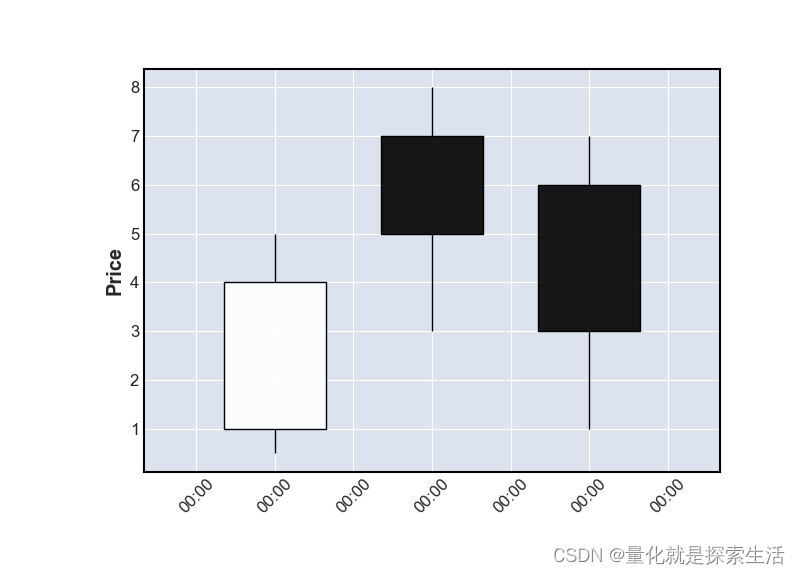

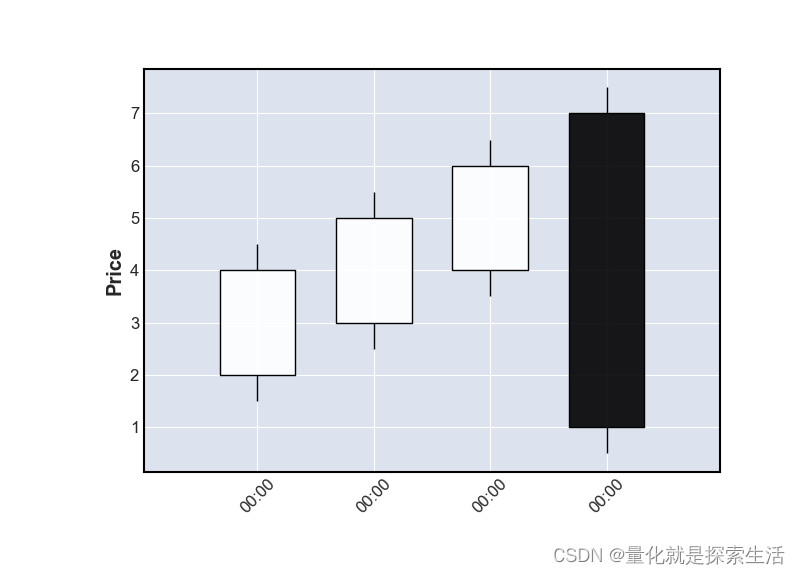

CDL3LINESTRIKE(三线打击)

python函数原型:

cdl3linestrike = CDL3LINESTRIKE(open, high, low, close)

解释:

(1)三天连续阳线

(2)每天阳线收盘价大于前一日收盘价

(3)开盘价接近(near)前一日实体之内

(4)第四日高开,跌破第一日开盘价,被认为是上涨信号

(5)阴线情况相反

三连阳情况

第一根阳线:

O

P

E

N

−

3

<

C

L

O

S

E

−

3

OPEN_{-3} < CLOSE_{-3}

OPEN−3<CLOSE−3

第二根阳线:

O

P

E

N

−

2

<

C

L

O

S

E

−

2

O

P

E

N

−

3

−

N

e

a

r

<

=

O

P

E

N

−

2

<

=

C

L

O

S

E

−

3

+

N

e

a

r

C

L

O

S

E

−

2

>

C

L

O

S

E

−

3

OPEN_{-2} < CLOSE_{-2} \\ OPEN_{-3}-Near<= OPEN_{-2} <= CLOSE_{-3}+Near \\ CLOSE_{-2} > CLOSE_{-3}

OPEN−2<CLOSE−2OPEN−3−Near<=OPEN−2<=CLOSE−3+NearCLOSE−2>CLOSE−3

第三根阳线:

O

P

E

N

−

1

<

C

L

O

S

E

−

1

O

P

E

N

−

2

−

N

e

a

r

<

=

O

P

E

N

−

1

<

=

C

L

O

S

E

−

2

+

N

e

a

r

C

L

O

S

E

−

1

>

C

L

O

S

E

−

2

OPEN_{-1} < CLOSE_{-1} \\ OPEN_{-2}-Near<= OPEN_{-1} <= CLOSE_{-2}+Near \\ CLOSE_{-1} > CLOSE_{-2}

OPEN−1<CLOSE−1OPEN−2−Near<=OPEN−1<=CLOSE−2+NearCLOSE−1>CLOSE−2

第四根阴线:

O

P

E

N

0

>

C

L

O

S

E

−

1

C

L

O

S

E

0

<

O

P

E

N

−

3

OPEN_{0} > CLOSE_{-1} \\ CLOSE_{0} < OPEN_{-3}

OPEN0>CLOSE−1CLOSE0<OPEN−3

三连阴情况类似

重构代码(来自ta_CDL3LINESTRKE.c, 有修改, 只保留逻辑):

def CDL3LINESTRIKE_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 9:

high_low_range_20per = (high - low) * 0.2

near = high_low_range_20per.rolling(5).mean().shift(1)

# 三阳线

# 第一根阳线

condition_1_1 = (close.shift(3) > open.shift(3))

# 第二根阳线

condition_1_2 = (close.shift(2) > open.shift(2)) & \

(close.shift(2) > close.shift(3)) & \

(open.shift(2) >= open.shift(3) - near.shift(3)) & \

(open.shift(2) <= close.shift(3) + near.shift(3))

# 第三根阳线

condition_1_3 = (close.shift(1) > open.shift(1)) & \

(close.shift(1) > close.shift(2)) & \

(open.shift(1) >= open.shift(2) - near.shift(2)) & \

(open.shift(1) <= close.shift(2) + near.shift(2))

# 第四根阴线

condition_1_4 = (close < open) & \

(open > close.shift(1)) & \

(close < open.shift(3))

cdl3linestrike = np.where(condition_1_1 & condition_1_2

& condition_1_3 & condition_1_4, 100, 0)

# 三阴线

# 第一根阴线

condition_2_1 = (close.shift(3) < open.shift(3))

# 第二根阴线

condition_2_2 = (close.shift(2) < open.shift(2)) & \

(close.shift(2) < close.shift(3)) & \

(open.shift(2) >= close.shift(3) - near.shift(3)) & \

(open.shift(2) <= open.shift(3) + near.shift(3))

# 第三根阴线

condition_2_3 = (close.shift(1) < open.shift(1)) & \

(close.shift(1) < close.shift(2)) & \

(open.shift(1) >= close.shift(2) - near.shift(2)) & \

(open.shift(1) <= open.shift(2) + near.shift(2))

# 第四根阳线

condition_2_4 = (close > open) & \

(open < close.shift(1)) & \

(close > open.shift(3))

cdl3linestrike = np.where(condition_2_1 & condition_2_2

& condition_2_3 & condition_2_4, -100, cdl3linestrike)

cdl3linestrike[:8] = 0

else:

cdl3linestrike = np.zeros(_len).astype(int)

return cdl3linestrike

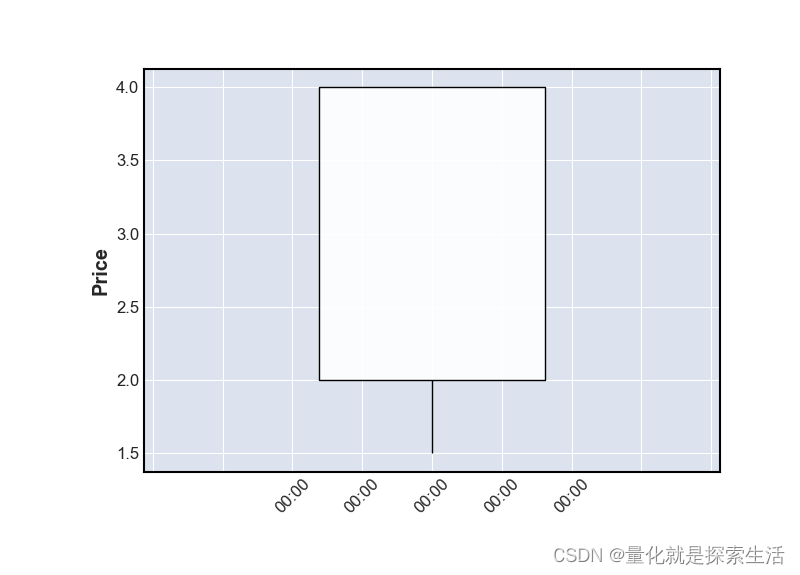

CDLCONCEALBABYSWALL(藏婴吞没)

python函数原型:

cdlconcealbabyswall = CDLCONCEALBABYSWALL(open, high, low, close)

四日连续阴线,前两日无影线

第三日跌出实体缺口,但有不短的上影线,且最高价超过第二日收盘

第四日最高和最低价包裹第三日

底部信号

重构代码(来自ta_CDLCONCEALBABYSWALL.c, 有修改, 只保留逻辑):

def CDLCONCEALBABYSWALL_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 14:

high_low_range = high - low

shadow_very_short = high_low_range.rolling(10).mean().shift(1) * 0.1

shadow_upper = high - np.maximum(close, open)

shadow_lower = np.minimum(close, open) - low

condition_1 = (close.shift(3) < open.shift(3)) & \

(shadow_upper.shift(3) < shadow_very_short.shift(3)) & \

(shadow_lower.shift(3) < shadow_very_short.shift(3))

condition_2 = (close.shift(2) < open.shift(2)) & \

(shadow_upper.shift(2) < shadow_very_short.shift(2)) & \

(shadow_lower.shift(2) < shadow_very_short.shift(2))

condition_3 = (close.shift(1) < open.shift(1)) & \

(shadow_upper.shift(1) > shadow_very_short.shift(1)) & \

(open.shift(1) < close.shift(2)) & \

(high.shift(1) > close.shift(2))

condition_4 = (close < open) & \

(high > high.shift(1)) & \

(low < low.shift(1))

cdlconcealbabyswall = np.where(condition_1 & condition_2 & condition_3 & condition_4, 100, 0)

else:

cdlconcealbabyswall = np.zeros(_len).astype(int)

return cdlconcealbabyswall

六. 五K线模型

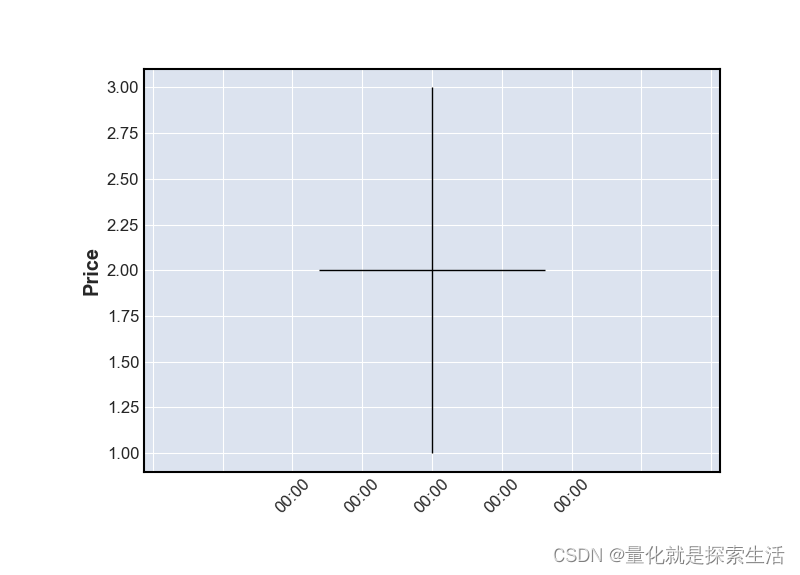

CDLBREAKAWAY(脱离)

python函数原型:

cdlbreakaway = CDLBREAKAWAY(open, high, low, close)

以看涨脱离为例,大阴线后低开形成实体缺口,继续走低

第三日和第四日阴线的high和low持续走低

第五日反弹收盘在一二日缺口内(中文百科中无此要求)

重构代码(来自ta_CDLBREAKAWAY.c, 有修改, 只保留逻辑):

def CDLBREAKAWAY_(open, high, low, close):

_len = len(open)

open, high, low, close = pd.Series(open), pd.Series(high), pd.Series(low), pd.Series(close)

if _len >= 15:

real_body = abs(open - close)

body_long = real_body.rolling(10).mean().shift(1)

# 看涨脱离

condition_1_1 = (close.shift(4) < open.shift(4)) & (real_body.shift(4) > body_long.shift(4))

condition_1_2 = (close.shift(3) < open.shift(3)) & (open.shift(3) < close.shift(4))

condition_1_3 = (close.shift(2) < open.shift(2)) & \

(low.shift(2) < low.shift(3)) & \

(high.shift(2) < high.shift(3))

condition_1_4 = (close.shift(1) < open.shift(1)) & \

(low.shift(1) < low.shift(2)) & \

(high.shift(1) < high.shift(2))

condition_1_5 = (close > open) & (close > open.shift(3)) & (close < close.shift(4))

# 看跌脱离

condition_2_1 = (close.shift(4) > open.shift(4)) & (real_body.shift(4) > body_long.shift(4))

condition_2_2 = (close.shift(3) > open.shift(3)) & (open.shift(3) > close.shift(4))

condition_2_3 = (close.shift(2) > open.shift(2)) & \

(low.shift(2) > low.shift(3)) & \

(high.shift(2) > high.shift(3))

condition_2_4 = (close.shift(1) > open.shift(1)) & \

(low.shift(1) > low.shift(2)) & \

(high.shift(1) > high.shift(2))

condition_2_5 = (close < open) & (close < open.shift(3)) & (close > close.shift(4))

cdlbreakaway = np.where(condition_1_1 & condition_1_2 & condition_1_3 & condition_1_4 & condition_1_5, 100, 0)

cdlbreakaway = np.where(condition_2_1 & condition_2_2 & condition_2_3 & condition_2_4 & condition_2_5,

-100, cdlbreakaway)

else:

cdlbreakaway = np.zeros(_len).astype(int)

return cdlbreakaway

免责声明

本文仅为技术解析文档,内容全部开放,不对任何个人或机构提供任何投资建议